As will freight rates – but preferential treatment and technology deployment will help mitigate supply-chain problems.

The COVID-19 pandemic, and its consequent supply-chain congestion, may have caught up with the refrigerated cargo business—but less so compared to other cargo categories. Global supply chains are now clogged with all kinds of cargo—from furniture and exercise equipment to appliances and apparel—as well as the fruits, vegetables, meats, and seafood that transit in refrigerated containers. But reefers appear to be faring better than other cargo categories.

The refrigerated container business has been growing strongly in recent years. Increased demand for year-round availability of a variety of refrigerated consumables has consistently been filling those boxes. The reefer business has also benefitted from a shift from bulk refrigerated ships to containers (although the current congestion has breathed some life, probably short-lived, into the bulk refrigerated segment.) That’s why companies like SeaCube Container, a lessor of containers and equipment, has increasingly emphasized the reefer side of its business in recent years.

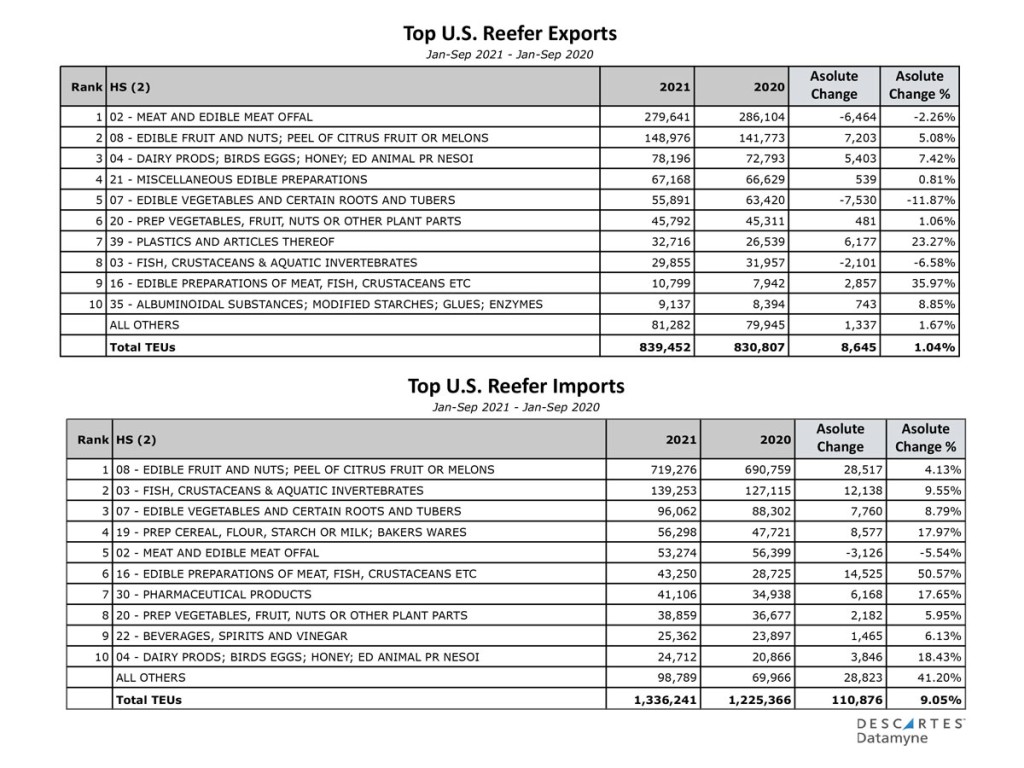

In the early days of the pandemic, volumes of many cargo categories plummeted, but demand for perishables suffered less, and then rebounded nicely, as more people ate at home and sought more fresh foods. The analysts at Drewry found that the ocean perishables trade in 2020 declined by 0.4%, but that reefer volumes advanced 0.3% to 5.4 million TEU.

Later, demand for all sorts of goods spiked, as people started spending on home improvements and home offices, among other things, while refrigerated cargoes proceeded apace. During the first half of 2021, seaborne reefer traffic expanded by 4.8% year over year, led by higher volumes in the meat, citrus, and exotics trades, according to Drewry. Now, reefer operators and cargo owners have to contend with the clogging of the supply chain, but maybe not as much as those involved in other categories of cargo.

Reefer Priority

“Reefers always receive prioritized stowing,” explained Greg Tuthill, senior vice president and chief commercial officer of the Woodcliff, New Jersey-based SeaCube. “We haven’t seen as much delay as they have in the dry cargo segment but we are not immune to congestion either.”

While refrigerated cargoes may do better than others making it through container terminals, “We still face the same challenges getting cargo through the network,” said Tuthill. “Labor and network space constraints” are proving to be the business’s biggest headaches right now, he said.

Some of those same trends are reflected in results reported for the second quarter of 2021 by Fresh Del Monte Produce, which saw its gross profit of $110.0 million increase by 40% and its 9.6% profit margin increase by 33.3%. In North America, the company reported increased sales and profits for pineapples and melons and in its fresh-cut fruit, fresh-cut vegetable, and prepared food product lines. All this, despite being faced with higher fuel, inland freight, packaging, production, and procurement costs, and “unprecedented disruptions in global supply chains and shortages of labor,” said Mohammad Abu-Ghazaleh, the company’s CEO, on an earnings call with analysts and journalists.

Reefer ocean freight rates have also seen increases, although at a more moderate rate than for dry container cargo, but that state of affairs is not expected to continue. Drewry’s Global Reefer Container Freight Rate Index, which examined rates across the 15 reefer trade routes, saw an increase so far this year of 50% at the end of the third quarter, while dry container freight rates have more than doubled during the same period. But Drewry foresees freight rates for dry cargo declining in 2022, as trade conditions normalize, while reefer rates will continue to rise.

Tuthill sees the reefer market growing at a 5% to 6% pace through 2023, with increases in demands for specialty products and the continued globalization of the trade in refrigerated commodities. Consumers will continue their quests to follow healthy diets, and that means consuming fresh foods from around the world throughout the year.

“If you go back to the 1970s, 80% to 90% of perishables were sourced locally,” said Tuthill. “Now that figure is closer to 50%.” Avocados, citrus fruit, and blueberries are all examples of commodities that have benefitted from this phenomenon.

Beyond fresh fruits and vegetables, Tuthill sees fresh seafood as a growth area for the reefer business. “The seafood industry has come under some distress because fishing stocks have been depleted in 13 out of the 15 regions of the globe,” he said. That has led to more fish farming, which, in turn, is amenable to a globalized container trade.

Telematics

As with other segments of trade and transportation, technology is playing a big role in driving improvements in the reefer business. “The biggest trend right now is telematics, which is tied to monitoring cargo conditions such as temperature and humidity,” said Tuthill.

Telematics also supports remote diagnostics, which allows operators to change conditions within a container to accommodate changing conditions, such as supply-chain delays. “Respiration rates can be slowed down to extend the shelf life of commodities,” Tuthill explained. “Eighteen days of transit time used to be the maximum. Now we can get 30 days of transit with favorable outcomes and lower failure rates.” Trade in cherries, apples, and avocados have all benefitted from remote diagnostics.

SeaCube announced in April, it is the first intermodal equipment leasing company to incorporate Carrier’s Lynx Fleet solution into its fleet with an initial deployment of 2,000 PrimeLINE refrigerated container units. The Lynx Fleet technology, which incorporates internet of things (IoT) analytics, machine learning, and big-data technologies, monitors reefer performance and provides early warning diagnostics and predictive analytics on the machine’s components. The Carrier Lynx Fleet system provides more detailed performance analysis capabilities compared to other platforms, according to Tuthill, and will also provide improved fleet uptime, reduced operational and maintenance costs, and lower levels of cargo spoilage.

In the future, predictive analytics will be the key technology to be applied to the reefer container business, according to Tuthill. “Data integration and synchronization will lead to better supply chain efficiency and asset management,” he said, “and that will result in better turn times and improved handoffs from vessel to truck to cold chain.”