Greg Tuthill, Senior VP CCO of SeaCube Containers discusses the current reefer market and the potential impact of new technologies on the business.

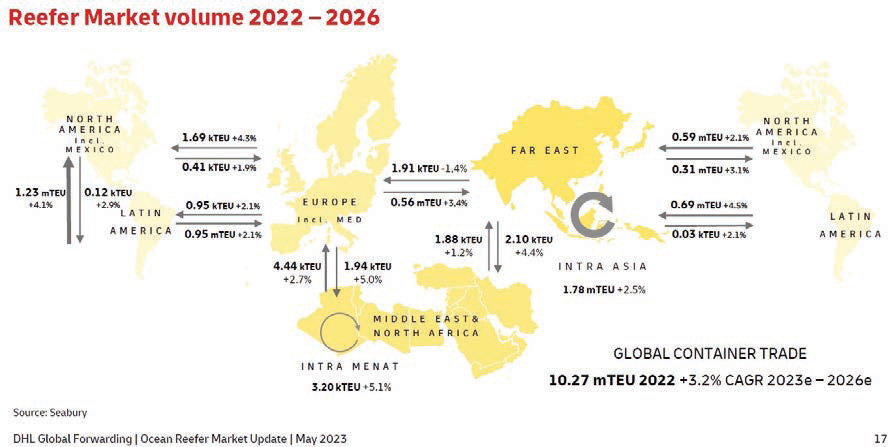

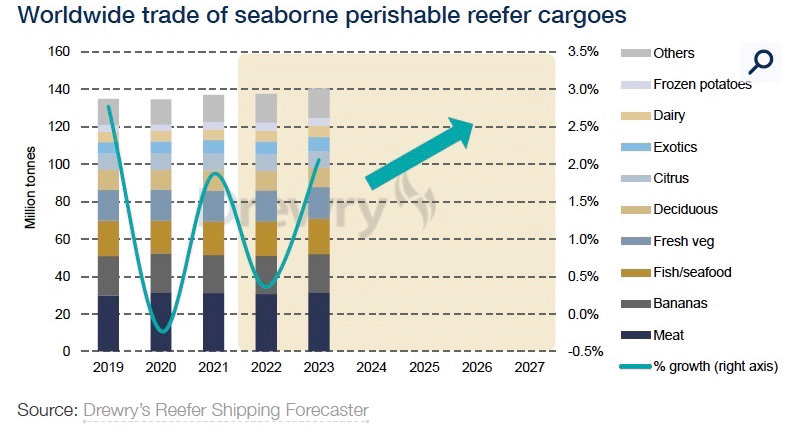

The logistics of perishables is significantly different than that of dry freight, especially as pertains to the seaborne movement of refrigerated containers, better known as reefers. As with dry containers, the reefer business experienced some “headwinds” early in the year. There were plenty of reasons for the early slowdown in reefers — almost an inevitability coming out of a lackluster 2022. But no less an authority than Drewry’s in their May market report noted they are expecting reefer “volumes to increase by 2.1%” globally.

Is their optimism justified given the political, economic, and ecological conditions shaping the highly complex reefer market?

Greg Tuthill, senior vice president and chief commercial officer of SeaCube Containers, one of the world’s largest purchasers and lessors of reefers, has a keen perspective on perishables and the reefer business. Besides his current stint with SeaCube, Tuthill’s worked on the boxship side of the business with NYK, CMA CGM and APL [which was acquired by the aforementioned CMA CGM] during his three decade plus career.

Nuanced Demand

When asked by AJOT what impact the downturn in demand — especially to the U.S. West Coast — had on the reefer side of the business, Tuthill explained the market’s current dynamics, “I think the headwinds that are characterizing the market this year are related to oversupply, lower demand and just some of the economic fundamentals, higher interest rates, inflation. That being said, it’s impacting the dry market more than the refrigerant market. The reefer market has been a lot more resilient, but it’s also been a little slower than some of the previous years. So, the reefer market’s holding up okay, and with the reopening in China, that’s certainly offering some positive momentum. I think some of the other markets that are starting to develop are also a little bit more favorable in terms of showing some positive growth depending on commodity. There’s some areas that are a little bit more favorable than others in the refrigerated market.”

As Tuthill points out the demand in the reefer sector is much more nuanced, “Meat and seafood commodities are certainly only not much better than some of the other fruit and perishable markets. Specifically, bananas have had a real tough market, but that’s starting to improve. Some of the fruit markets have been impacted by some of the climate change, including El Nino and flooding. High fertilizer costs have impacted some of the farmers from just an economic standpoint where that’s proving to be financially challenging for them. So, it’s kind of a mixed outlook, but still positive.”

Overall, Tuthill aligns with the Drewry assessment that the growth rate should be in the “2 1/2% to maybe closer to 3%” range with a stronger second half of the year.

Seasonality and Seasonality

Traditionally containership rotations have rhythm or seasonality — a peak season — that some boxship pundits postulate has evaporated in the post-COVID shipping cycles. But in the reefer business seasonality is an important, even critical factor in shipping. “There’s less flexibility with obviously perishable commodities than there is with dry cargo retail type products, especially on the apparel side. You can’t store perishables for too long before that particular inventory goes bad, so the traditional seasonality of the reefer market will most likely continue the way it has in the past just because you can’t really get around that,” Tuthill remarked on seasonality in the reefer sector. Of course, there is a cold storage factor to be considered in the movement of perishables and Tuthill notes, “on the cold chain market some of the frozen markets you can get away with shipping inventory and storing it. So, that could go ahead and make a little bit of a difference where you can go ahead and start to have inventory cycles that are maybe a little different going forward. But even with that, the seafood markets and including some of the fish farming markets with the meats, the frozen poultry, [and] things like that, I think that will maintain its cycles. And I don’t think you’ll see too much of a shift. The big thing with the dry market, which is different than the reefer market, is there’s leftover inventory that is basically being stored that can go a full cycle all the way into the next year and be restocked for holidays that were intended for the previous year.”

Disruptions, Dislocations and Markets

As with the supply chain in general, the cold chain has been disrupted by a number of disparate events. Politically the Ukraine-Russia war has certainly caused disruptions in Europe but as Tuthill points out, these were relatively minor in relations to the entirety of perishable movements, “The Ukraine impact was very minimal based on the percentage [of the market]. But I think some of the relay ports like Rotterdam, they had some impact like congestion. So, congestion was probably more the problem than anything else in trying to get reefer cargo out of Rotterdam and moving. So, velocity was more of an impact than the actual market tied to Russia, Ukraine and some of the other areas impacted by the war, Tuthill said.

Another problem for boxships has been the water restrictions imposed on Panama Canal transits. Again, Tuthill doesn’t see the restriction having much impact on the overall movements of reefer cargo although it does speak to the larger issue of climate.

Tuthill says “Reefer always gets a priority and knowing that it’s 10% of the total load out it probably won’t see too much impact … you’re not going to cut high value, high perishable, time-sensitive type cargo, which is the reefer category. But the question ties into other points and that as climate change is impacting sourcing options for those who are procuring perishables to the extent that they’re having to have contingencies based on some of the unplanned shortages of perishables.”

However, other issues like the evolving perishables market in China have had a much greater impact on reefer movements. Tuthill said of the China market, “Going back to COVID, there was some restrictions on inbound cargo going into China because of COVID inspections. So, that was certainly a risk for shippers, and I think that since obviously that’s all been restored to normal operations, there’s not that impact anymore.” Adding, “Generally speaking, I think that both inbound and outbound out of China, since the reopening has improved. So, there’s been some improvement in momentum [for perishables] relative to growth into and out of China. Still, there are obviously some sourcing considerations, both into and out of China that kind of ties to some of the other political framework in terms of sourcing from alternative areas. This is going to start to impact some of the cargo flows.”

Technology, Decarbonization and Reefers

Technology is intrinsic to the reefer business, if for no other reason than the refrigerants themselves. But the rise of AI and other technological innovations have opened the door to a whole new array of applications. But just how will AI impact the reefer market? And of AI Tuthill says, “Whether that [AI] enhances what we currently have or whether that starts to streamline the delivery loading and the planning process is going to be interesting, because I think there’s going to be applications tied to that [process]. The conveyance of reefer cargo has a lot of upside using more technology.”

And for the shipping industry the elephant in the room is decarbonization. “The decarbonization compliance regulations and because that’s going to be such a big priority, it’ll be tied all the way back into refrigerated container movement because of the machinery, because of the refrigerant, because of the energy demand, and efficiency — all of that will have a big, big impact on how the vessels operate. The energy demand related to operating the reefer fleet on board [the containership] is going to have a direct impact on all that. So, just like vessels are being replaced probably in a shorter cycle time than they ever were before because of decarbonization… reefer fleets are going to also be replaced in a shorter timeframe. The replacement ratio I would say would be maybe higher and durations would be shorter because of decarbonization requirements.”

Tuthill believes that the decarbonization efforts will fundamentally change the reefer industry from the ground up, “Just my views, but I think that’s going to tie all the way back through the reefer market, especially because telematics and technology is going to be required for audits and scorecard development [related to decarbonization ratings]. I have more interesting discussions with our customers about decarbonization preparation planning than I do about lease rates, at least products. And I say that because we [SeaCube] have to look forward with an eye towards what we invest in on a 15-year time horizon because we depreciate reefer assets over 15 years. So, that information’s really important.”